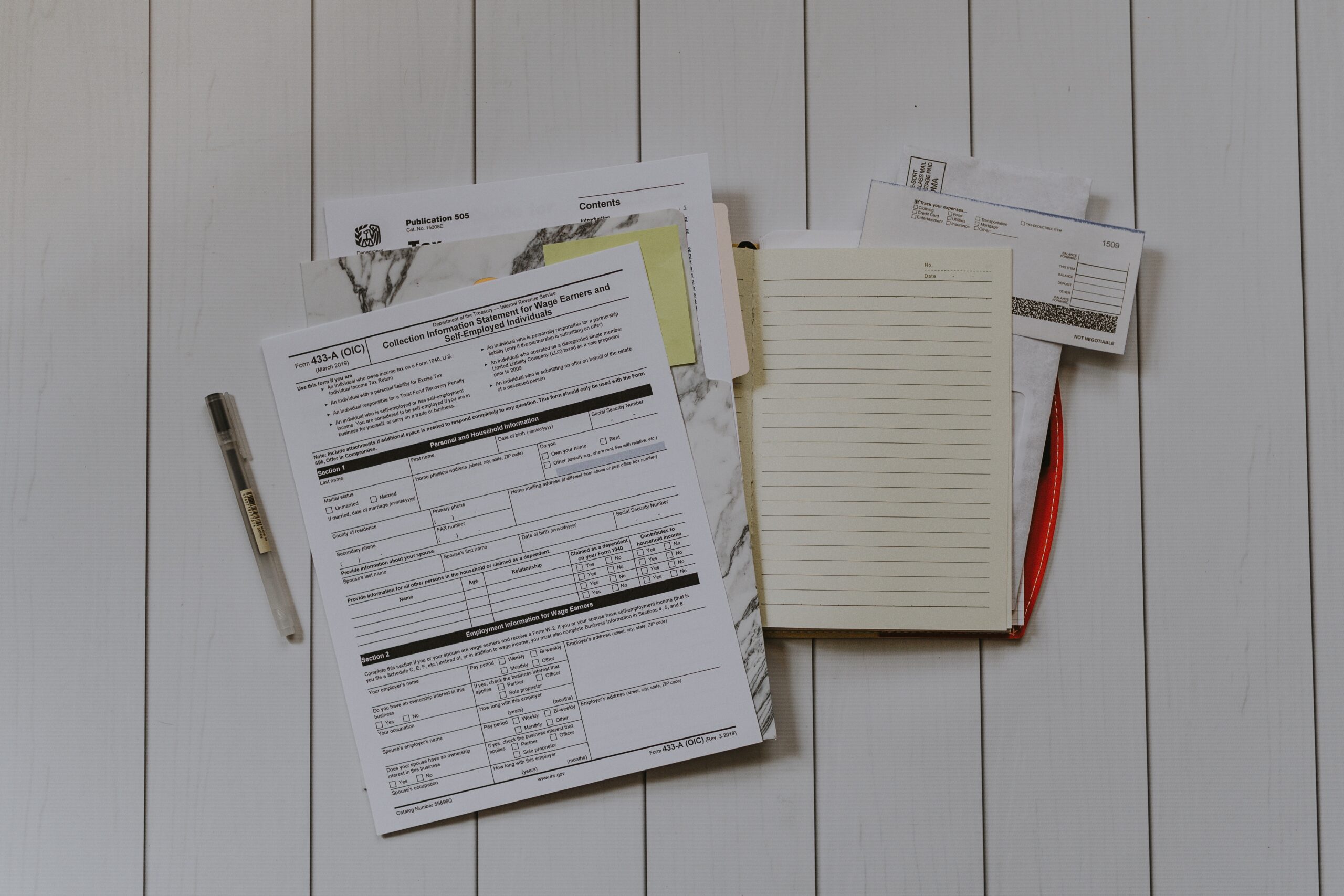

Tax Preparation

Consulting for small & medium sized business professional, fast & affordable

5 Steps in Tax Preparation

When preparing to file tax returns in China, the following steps are essential:

1. Gather relevant financial and tax information: Gather all relevant financial and tax documents. This includes income statements, expense records, receipts, invoices, and any other relevant financial records.

2. Determine Applicable Tax Categories: Identify the specific tax categories that are relevant to your business. These may include value-added tax (VAT), corporate income tax (CIT), individual income tax (IIT), and social security contributions.

3. Calculate taxable amounts: Crunch the numbers! Calculate taxable amounts based on the applicable tax rules and rates for each category. This includes estimating taxable income, deductible expenses, and potential tax credits or incentives.

4. Complete tax forms and returns: Roll up your sleeves and accurately complete the required tax forms. Provide essential information, including financial data and transaction details, as required by tax authorities.

5. Submit tax returns and payments: Submit your completed tax returns and make required tax payments promptly and by the required deadlines. Compliance with filing and payment requirements is critical.

A meticulous approach will ensure a smooth tax season.

Frequently Asked Questions

In China, the major taxes include Value-added tax (VAT): A consumption tax collected from customers and paid to the tax authorities. Rates vary depending on the goods or services. Corporate income tax (CIT): A 25% tax on corporate profits, with some exceptions. Compliance is critical. Individual Income Tax (IIT): A progressive tax on individual income. Deductions and exemptions affect the calculation. Social Security Contributions: Both employers and employees contribute to funds for pensions, health insurance, etc. Compliance is important. Regular consultation with our tax professionals to stay abreast of regulations is essential for effective tax management of your business in China.

In China, tax filling deadlines depend on the type of tax and the taxpayer's individual circumstances. Generally, tax returns that are due on a monthly or quarterly basis should be submitted no later than 15 days after the end of the reporting period. For annual tax returns, the deadline is May 31 of the following year. This schedule provides taxpayers with a structured timeline for meeting their tax obligations.

In fact, China has introduced several tax incentives and deductions to encourage certain activities or sectors. These financial benefits can take the form of preferential tax rates, exemptions, or deductions. They are often extended to companies engaged in research and development, high-tech companies, and small and micro enterprises, among others. This strategy is designed to stimulate growth and innovation in these key areas.

In China, the requirement for certain companies to undergo an annual tax audit by an accredited accounting firm is determined by several factors. These include the size of the company, the industry in which it operates, and its status as a listed company. This ensures that the audit process is tailored to the specific circumstances of each company.

Failure to comply with Chinese tax regulations can have serious consequences, including penalties, fines, and even legal consequences. As a result, it's critical to file accurate and timely tax returns, maintain proper recordkeeping practices, and ensure full compliance with tax laws. This vigilance is key to avoiding potential penalties.

Lets get started

Our have the best people with whom we can overcome allobstacles in our way, with whom we confidently look to the future.